1Q-2024 - BFF Banking Group

1Q 2024

Spain and its territorial entities in 1Q 2024: consequences of the possible forgiveness of debt to the Autonomous Communities

Executive Summary

The global macro scenario: three major trends

Firstly, global economic activity has maintained a certain dynamism in recent quarters, despite the restrictive tone of monetary policy and multiple geopolitical uncertainties. In fact, in the third quarter of 2023, upward surprises in GDP growth predominated, particularly in the United States, thanks to the strength of employment and private consumption, and in China, in a context of greater fiscal support to counteract the weakness of the real estate sector. However, activity was weaker than anticipated in some regions, such as the euro area and Japan.

The preliminary growth data for 4Q23 continue the same trend as in 3Q23, with the United States once again comfortably exceeding the market consensus, sluggishness in Europe, mainly in the countries with the greatest weight in the manufacturing and export sector. China, while the latter continues the weak dynamics of the second half of 2023, with the Central Bank of China implementing the first stimulus measures.

FIGURE 1 GDP growth forecasts (% year-on-year)

Source IMF

Secondly, in recent months the disinflationary process has continued, even with a greater intensity than expected in some geographies. The decline in inflationary pressures has continued to be more pronounced in headline inflation rates than in core rates, the pace of moderation of the latter continues to be conditioned by the greater relative persistence of services inflation. All of this, in a context in which energy prices, which in recent times have shown considerable volatility, have tended to surprise downwards, especially oil prices.

In fact, the latest Eurosystem projections revised the growth prospects for 2023 and 2024 slightly downwards, to 0.6% and 0.8%, respectively, rates that are below potential growth, while the forecast of 1.5% for 2025 has been maintained. The expected recovery path would be supported, above all, by private consumption, favored by the increase in the real disposable income of households in a context of wage growth and declines in inflation. A favorable evolution of external demand is also expected, although its contribution to growth will be limited by the loss of market share of euro area exports.

In particular, risks to economic growth remain skewed to the downside. In addition to geopolitical developments, the transmission of monetary policy has been surprising us for its strength, which, if extended in the coming years, would translate into lower growth.

The Spanish economy in 2023-2025

As for the Spanish economy, it has been affected by the slowdown of the global economy in recent months and, in particular, by the situation in the euro area. However, it has shown a considerable degree of dynamism. Thus, the quarterly growth rate was reduced during 2023, reaching 0.4% in the third quarter according to the recent upward revision by the INE, one tenth less than in the previous quarter and the available data suggested in principle a similar advance for the fourth quarter of 2023.

The GDP growth in the third quarter once again rested on domestic demand, particularly in private consumption and investment in capital goods, which showed quarter-on-quarter increases of 1.4% and 2%, respectively. On the contrary, the contribution of net foreign demand to growth was negative, as a result of the decline in exports, weighed down, fundamentally, by the slowdown in global and European economic activity, higher than that observed in imports.

The first provisional growth figure for the Spanish economy in 4Q23 (subject to subsequent revisions), published on January 30 by the INE, has clearly surprised on the upside, with a growth of 0.6% in the last quarter of 2023 (two tenths more than in the previous one) and that would raise the growth of the Spanish economy to 2.5% for the year as a whole. Consequently, the level of activity in 4Q23 would be 2.0% higher than a year ago and it would be 2.9 percentage points above the pre-crisis maximum reached in the fourth quarter of 2019.

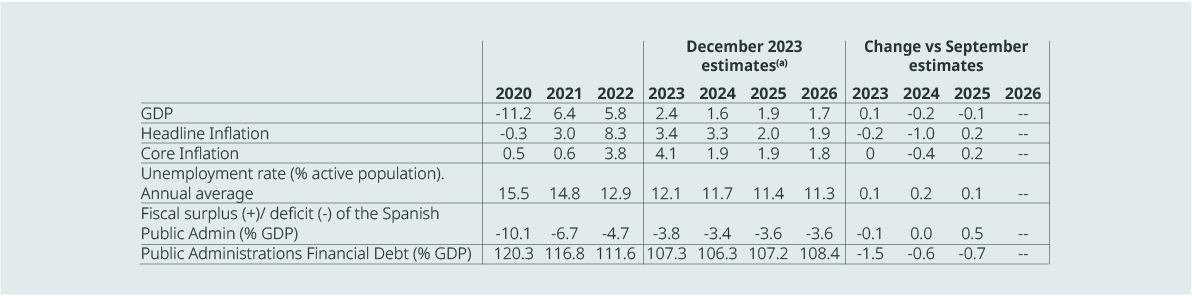

Looking ahead, according to the Bank of Spain’s projections (Figure 2), GDP growth is expected to slow down to 1.6% in 2024, before returning to accelerate slightly in the 2025-2026 biennium, when it will reach rates of 1.9% and 1.7%, respectively. These rates are above potential growth, which, if confirmed, would allow a progressive increase in the production gap.

FIGURE 2 Macroeconomic projections of the Spanish economy in 2023-2026

(a) YoY change (%) unless stated otherwise

Source: Bank of Spain

The main support for activity is internal demand. In particular, consumption will be favored by the increase in real incomes, in a context of moderating inflation rates. We also expect gross capital formation to also act as a driver of growth, largely due to the effect of the projects linked to the Next Generation EU (NGEU) programme, whose deployment should gain traction in 2024 and 2025.

In any case, the level of uncertainty remains high and the risks regarding these projections remain downward in relation to economic activity and they are balanced with respect to inflation.

As in the case of the euro area, the main source of risk is from the war conflicts in Ukraine and the Gaza Strip. Likewise, uncertainty also remains regarding the impact of the tightening of monetary

policy carried out to date.

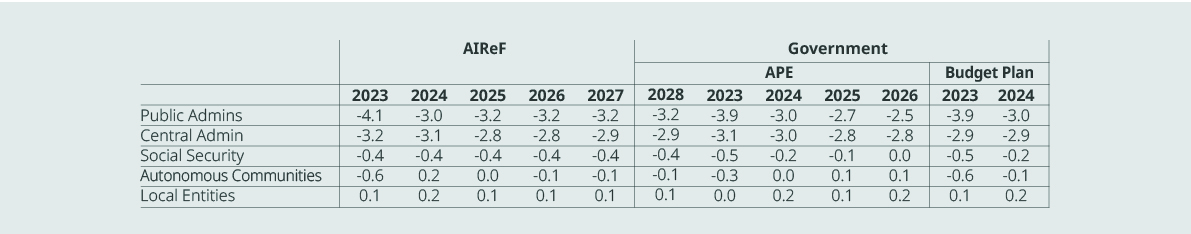

Fiscal outlook of the Spanish Public Administrations in 2024-2025

We maintain the estimate of the public deficit for the end of 2023 at 4.1% of GDP (Figure 3), which would imply a reduction of six tenths compared to the 2022 figure. In this scenario, the ratio of public expenditure to GDP has stood at 46.5% at the end of 2023, eight tenths below that observed at the end of 2022. On the other hand, public revenues would have continued without gaining dynamism, and its ratio would have been reduced by two tenths compared to 2022, reaching 42.4% of GDP. In 2024, in a context of extension of the State Budget and part of the measures aimed at alleviating the increase in energy costs (the cost of which is estimated at around 0.2 pp), the deficit would be reduced to 3.7 % of GDP. Without changes in fiscal policy, and considering the energy measures as temporary, the deficit would very slightly decline to 3.5% of GDP in 2025.

FIGURE 3 Fiscal deficit/surplus by public administration (% GDP) AIReF vs Budgetary Plan

Source: AIREF

These forecasts suggest that the contribution of the cyclical recovery of activity to the improvement of the deficit will be marginal and only the progressive withdrawal of anti-crisis measures will have an impact on reducing the imbalance in public accounts. As a result, the cyclically adjusted primary balance will remain around -2% of GDP, the same level as that reached at the end of 2019. In context, the spending ceiling for 2024 and the approved stability objectives do not point to an additional effort of fiscal rebalancing.

According to AIReF forecasts, the balance of the regions will improve substantially in 2024, registering a surplus of 0.2% of GDP, after closing 2023 in a deficit of 0.6%. AIReF calculates, therefore, that the balance of the subsector will improve eight tenths compared to what was expected in 2023 as a consequence, fundamentally, of the exceptional increase in the resources of the financing system derived from the 2022 settlement.

As a consequence of the uneven evolution of the financing system, the fiscal position will be in balance in 2025 and will subsequently deteriorate slightly until reaching a deficit of 0.1% in the rest of the period. On the contrary, the Rebalancing Plan proposes a surplus situation in 2025 and 2026.

The fiscal scenario presented in this report points to a smooth downward path in public debt during the 2023-2025 biennium. Due to the high interest rates and the persistence of the fiscal imbalance, only the growth of activity will contribute to the reduction of debt. Thus, the debt is expected to fall by just over 7.7 pp to around 104% at the end of the 2023-2025 biennium. To the extent that rates will remain high for some time and the recovery is slowing, this high level of debt puts Spanish public accounts in a vulnerable situation.

The great challenge for public finances is to define a strategy that sustainably reduces public debt and guarantees fiscal sustainability. According to AIReF calculations, the fiscal path that would comply with the guidelines contained in the proposal for the new fiscal framework would require taking measures during the period 2025-2028 worth 0.64 points of GDP per year, thus complying with the plausible debt reduction requirement in the most demanding scenario.

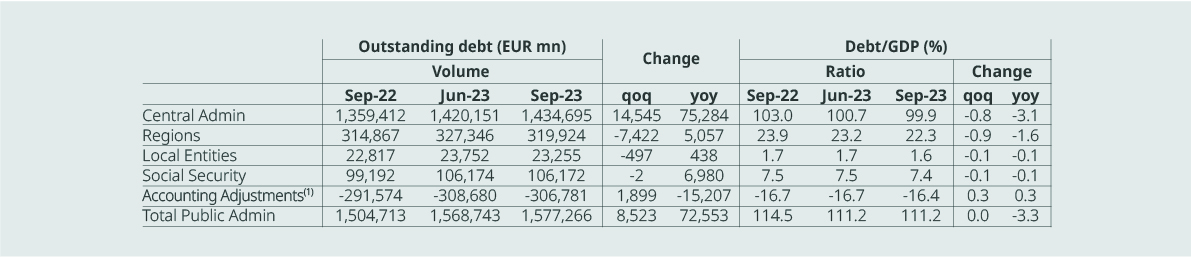

The stock of total public debt, for the third quarter of 2023, is around 1.58 trillion euros (Figure 4), 72,552 million more than the same period of the previous year (+4.8% y.a.). The increase in the debt stock slowed down in the last quarter, growing by only 0.5% (from 2.2% in the previous quarter), representing an increase of 8,522 million euros compared to the second quarter. However, in relative terms, the debt/GDP ratio fell 3.3 p.p. compared to the same period of the previous year, reaching 109.9%, thanks to the nominal growth of the economy.

FIGURE 4 Evolution of public debt by Public Administrations in 3Q23

(1) The methodology for calculating the level of total public debt in terms of the Excessive Deficit Protocol assumes the sum of the debt of each of the

adjusted levels of financial assets against the Public Admin

Source: Bank of Spain

The regional financial debt stood at 319,924 million euros, 2.3% lower than the record for the second quarter of 2023 (-7,422 million euros) and 1.6% higher (+5,057 million euros) than in 3Q22. This behavior

of the debt stock is mainly explained by the decrease in the debt of the Autonomous Communities during the last quarter in almost all regions, with the exception of Aragon, Extremadura and Castille-

Leon, which increased their stock. Considering the distribution of regional debt by instruments, we highlight that the weight of the FFCA remains at 59% of the total regional debt, registering

a year-on-year increase of 7,151 million euros, taking the extraordinary liquidity mechanisms’ debt stock to 189,426 million euros in 3Q23.

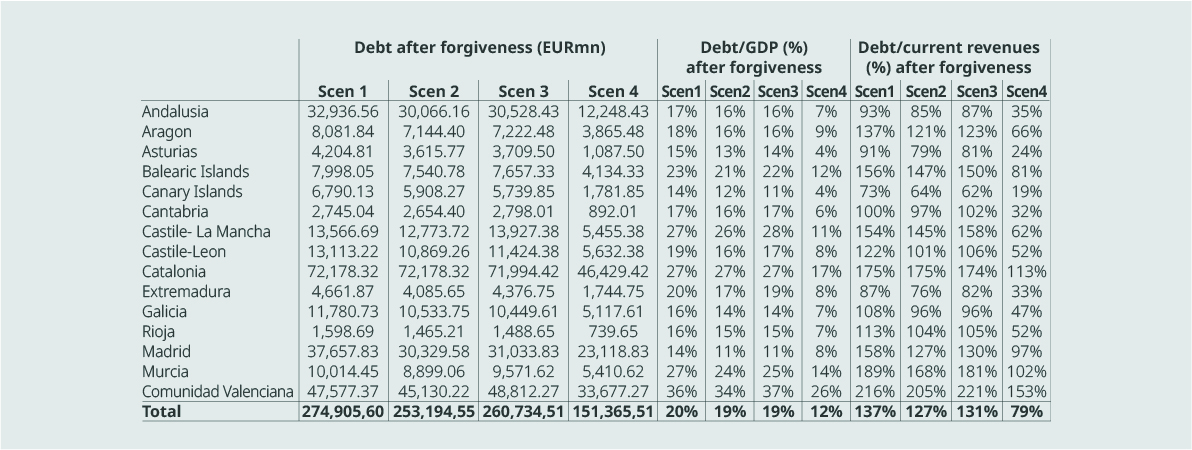

Scenarios for debt forgiveness of the Autonomous Communities

The investiture agreement of the PSOE with ERC explicitly states that it will proceed with the processing of a legal modification of general scope for all the common regime regions that allows the assumption by the State of part of the autonomous debt with the latter, caused by the impact negative of the economic cycle. In the specific case of Catalonia, it has been estimated that the impact of the cycle is the equivalent of 20% of its debt in the state liquidity provision funds (FFCA), and will represent around 15,000 million euros of Catalonia’s debt, and will mean savings of around 1,300 million euros in interest payments. If this agreement materializes with the group of autonomous governments of the common regime, the regional debt would undergo a significant restructuring that would improve its solvency and facilitate the capacity of the Autonomous Communities to return to the markets. The restructuring of the debt, however, should be linked to a reform of the regional financing system, so that its effects are not diluted by new economic crises that would once again weaken the sufficiency of the model.

With all this, different scenarios are proposed regarding debt forgiveness based on different variables, in order to determine what the impact of this reduction would be on credit fundamentals such as debt/GDP or on current revenues.

- Scenario 1: forgiveness of 20% of the debt contracted with the State since 2012.

- Scenario 2: forgiveness on the increase in total debt since 2012.

- Scenario 3: debt forgiveness for the deficit incurred between 2012 and 2014.

- Scenario 4: debt forgiveness for the deficit accumulated in the period 2009-2014, since the beginning of the current regional financing model and the recessive economic cycle.

FIGURE 5 Summary of the main outcomes of the proposed scenarios

Source: AFI

We commend the Government’s effort as an emergency measure at this time of processing the regional budgets, but we consider that that the forgiveness of part of the debt is a partial and incomplete solution. In this sense, they suggest the Ministry of Finance to begin the process of negotiating the change in the regional financing model, based on the conclusions of the reports of the commissions of experts appointed by the different regions and the Ministry of Finance in this regard.

The different political agreements between the PSOE and various nationalist parties pose at least two risks and one certainty. The certainty is that the general and unconditional forgiveness of a part of the debt of the common regime communities will contribute to aggravating the problems of fiscal indiscipline that they already suffer. The risks have to do with economic growth, employment and the sustainability of public accounts, on the one hand, and with social and territorial cohesion on the other.

The unconditional forgiveness of debt included in the agreement with ERC is an initiative that is not without risks, because it will aggravate the serious incentive problems that the common regime financing system (SFRC) already suffers from. Given previous experiences, any reduction not subject to strict adjustment conditions will tend to confirm the perception that the Autonomous Communities already have that they can systematically overspend, because in the end the State will rescue them in one way or another at no cost to them and constitutes, therefore, an invitation to fiscal indiscipline.

Going forward, the reform of the financing system and the establishment of rules for entry and exit from the FLA seem to be a priority.

In short, not going to the FLA has entailed an opportunity cost. However, this should be a temporary one. Therefore, the decision to keep open the option of financing in the markets is being rewarded by investors. Furthermore, going forward, in an environment in which the rest of the autonomous communities have to issue debt again or obtain bank financing, it is very likely that these differences will continue.

The differentiation in the cost of financing will be enhanced to the extent that the FLA ceases to be a preferential liquidity mechanism for the autonomous communities. It would be reasonable to think that, if they had to finance themselves in the markets, the autonomous communities adhering to the FLA would be paying, on average, twice as much as those that are outside, especially those that have a higher debt to GDP ratio.

Consequently, the costs of the FLA must lead to changes in its design and implementation. If there is enough evidence that there are autonomous communities with insufficient revenues to finance expenses, the problem must be resolved through reforms of the regional financing system. If, on the other hand, the current level of debt and the corresponding financial burden may be obstacles to the provision of essential public services or the return to the capital market of regionalgovernments, that problem must be addressed directly.

Ideally, access to a financing mechanism such as the FLA should be temporary, making the entry and exit conditions clear. Conditionality should include incentives, not only to reduce the imbalance in public accounts or the level of debt, but also to make adjustments through reforms that attract investment, generate employment, increase collection capacity and improve the efficiency of the regional governments.